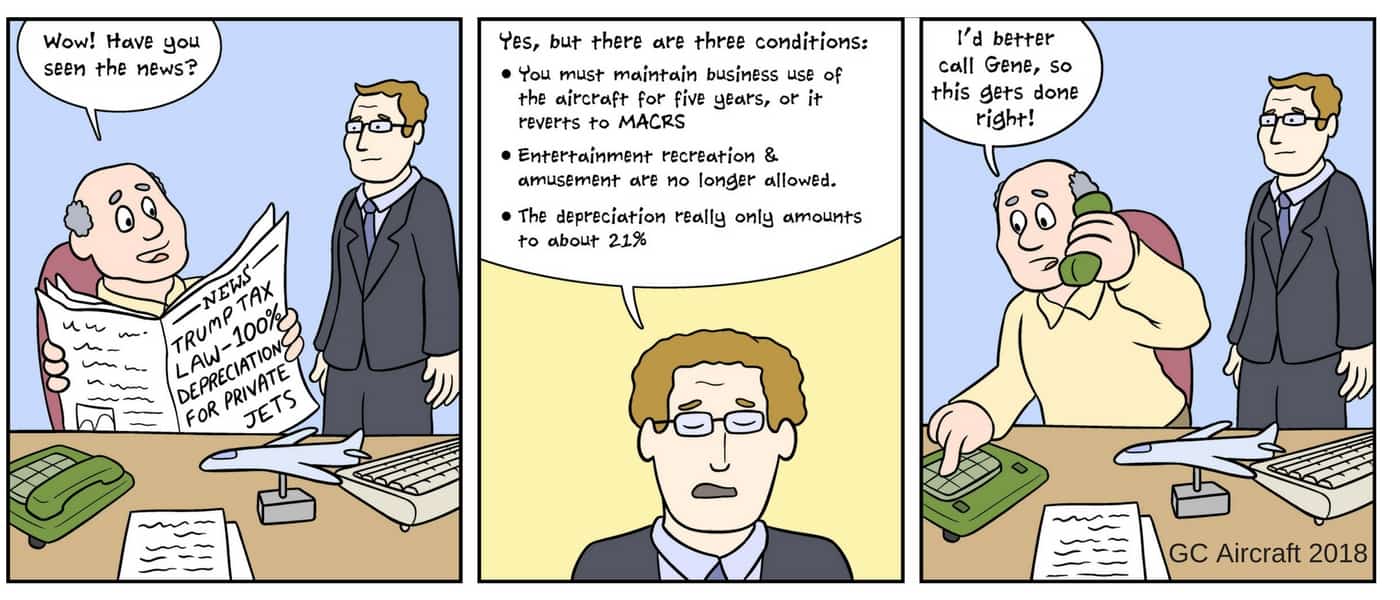

“Wow. Have you seen the news about the Trump Aircraft Depreciation Changes?

Yeah, but have you read the fine print? Your tax accountant will tell you . . .

- You must maintain business use of the aircraft for five years, or it reverts to MACRS*

- Entertainment, recreation and amusement are not allowed.

- The depreciation only really amounts to 21% for most business jet users.

While some inexperienced brokers would have you believe that “Donald Trump will buy you an airplane,” it’s really important to make sure that your transaction is well-planned and comes with no surprises.

We’re doing free consultations for people who have questions about the new depreciation laws and how they might affect your situation. Give us a call at (425) 822-7876 and let’s talk!

*The Modified Accelerated Cost Recovery System (MACRS) is the current tax depreciation system in the United States. Under this system, the capitalized cost (basis) of tangible property is recovered over a specified life by annual deductions for depreciation.